Things about Insolvency Melbourne

Table of ContentsFascination About Bankruptcy AustraliaThe Best Guide To Bankruptcy Advice MelbourneBankruptcy Australia Fundamentals ExplainedSome Known Incorrect Statements About Personal Insolvency Indicators on File For Bankruptcy You Need To Know

You'll then have time to deal with the court and also your creditors to determine the following actions. Will I Lose My Residential property? What takes place to your property relies on whether you submit chapter 7 or chapter 13 bankruptcy. If you're uncertain which choice is best for your scenario, see "Insolvency: Chapter 7 vs.Chapter 7Chapter 7 insolvency is frequently called liquidation personal bankruptcy because you will likely require to market off some of your possessions to please at the very least a section of what you owe. That said, state legislations establish that some properties, such as your retirement accounts, residence and also auto, are excluded from liquidation.

10 Simple Techniques For File For Bankruptcy

Phase 13With a chapter 13 insolvency, you do not require to fret about needing to liquidate any of your property to please your financial debts. Instead, your financial debts will be rearranged to ensure that you can pay them off partly or in full over the following three to five years. Maintain in mind, though, that if you don't abide with the payment plan, your lenders might have the ability to go after your possessions to satisfy your debts.

That claimed, both sorts of insolvency aren't treated the same way. Since phase 7 insolvency entirely eliminates the debts you include when you file, it can remain on your debt record for up to one decade. While chapter 13 insolvency is likewise not suitable from a credit scores perspective, its arrangement is watched even more favorably due to the fact that you are still paying off at the very least a few of your debt, as well as it will stay on your credit score record for approximately seven years.

There are some loan providers, nevertheless, who particularly work with individuals that have actually experienced insolvency or various other difficult credit rating events, so your choices aren't totally gone. The credit rating scoring versions favor new details over old information. With positive credit history routines post-bankruptcy, your debt score can recoup over time, even while the personal bankruptcy is still on your debt record.

The 4-Minute Rule for Bankruptcy Advice Melbourne

For the most component, it's more common for lawyers as well as lenders to use this system to look up information about your personal bankruptcy. Anyone can sign up and inspect if they want to.

This service is entirely free as well as can increase your credit report quick by utilizing your very own favorable settlement background. It can likewise aid those with inadequate or restricted credit situations. Various other services such as credit repair work might cost you up to thousands and also just help eliminate mistakes from your debt report.

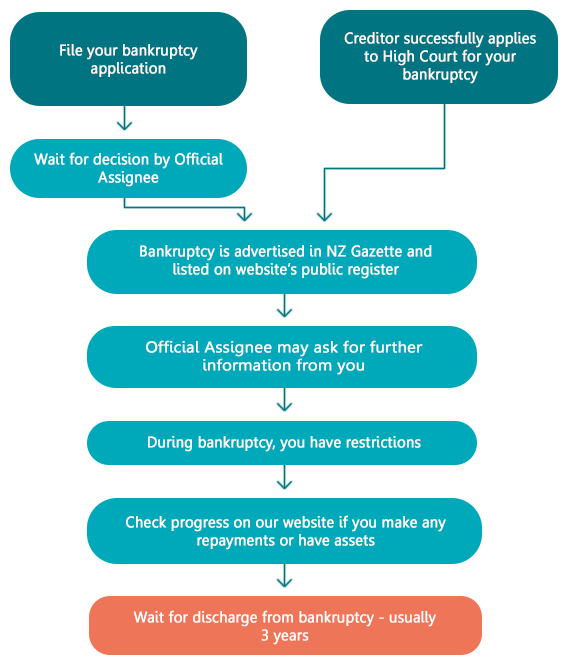

Personal bankruptcy is a lawful procedure where someone who can't pay their financial obligations can get remedy for an obligation to pay some or all of their debts. You should get assist from an economic coaching service and legal recommendations before getting personal bankruptcy. Becoming bankrupt has severe consequences and also there might be other options offered to you.

The 7-Second Trick For Personal Insolvency

AFSA knows regarding your commitments while bankrupt. There are serious repercussions to ending up being insolvent, including: your personal bankruptcy being ch 13 bankruptcy lawyers completely tape-recorded on the your clark and washington bankruptcy attorneys bankruptcy being noted on your credit score report for 5 years any type of possessions, which are not protected, perhaps being marketed not having the ability to travel overseas without the created authorization of the insolvency trustee not having the ability to hold the placement of a director of a company not being able to hold specific public placements bankruptcies 2019 being limited or prevented from continuing in some trades or professions your ability to obtain cash or get points on credit scores being influenced your ability to get rental accommodation your capacity to get some insurance coverage contracts your ability to access some services such as energies as well as telecommunication services.

You're permitted to keep some properties when you end up being bankrupt (Bankruptcy Australia).

It is really important to obtain lawful guidance before submitting for insolvency if you have a home. Financial debts you must pay regardless of personal bankruptcy You will certainly still have to pay some financial debts even though you have come to be bankrupt.

Rumored Buzz on Bankruptcy Melbourne

These consist of: court penalized and penalties maintenance financial obligations (including child assistance financial obligations) pupil assistance or supplement car loans (HELP College Car Loan Program, HECS College Contribution System, SFSS Trainee Financial Supplement Scheme) debts you incur after you end up being bankrupt unliquidated financial debts (eg automobile mishaps) where the quantity payable for the damages hasn't been fixed prior to the day of bankruptcythere are some exemptions financial debts sustained by scams debts you're accountable to pay due to misdeed (eg compensation for injury) where the quantity to be paid has actually not yet been dealt with (unliquidated problems)there are some exceptions to this.

It doesn't matter if you're bankrupt at the begin or become bankrupt throughout the case. You ought to tell the court, and also everyone included in your situation if you're bankrupt or in a personal insolvency agreement.